PROGRAM DESCRIPTION

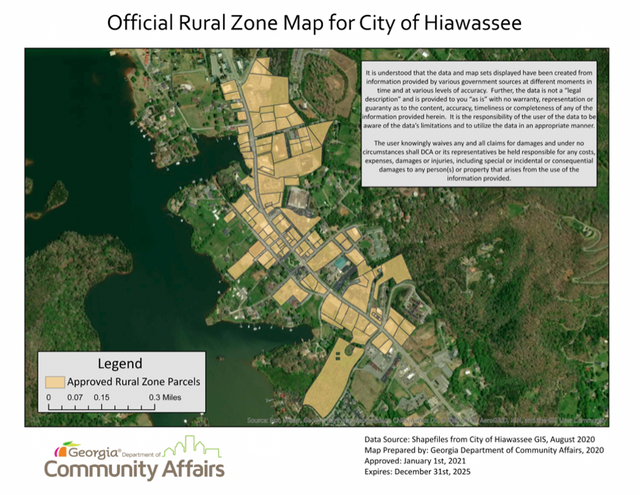

The Georgia Department of Community Affairs, or DCA, has awarded the core business district of downtown Hiawassee a five-year designation as a Rural Zone, beginning January 2021 – December 2026. This designation features a job tax credit, investment credit, and rehabilitation credit within the zone boundaries.

Rural Zone incentives can be layered with revolving loan funds offered through the Department of Community Affairs and the Georgia Cities Foundation, and several other state and federal programs.

Participation in the Rural Zone could make you ineligible to participate in some other programs, such as the state historic tax credit program. We can assist you in coordinating with the relevant state agencies to confirm your eligibility for the various programs in which you might be interested.

TAX CREDITS

The tax credits are applied against any income tax liability on the Georgia Corporate Income Tax Return.

Rural Zone Building Rehabilitation Standards

For more information or to confirm whether a property is in the designated Rural Zone, contact Denise McKay at [email protected] or (706) 896-2202.